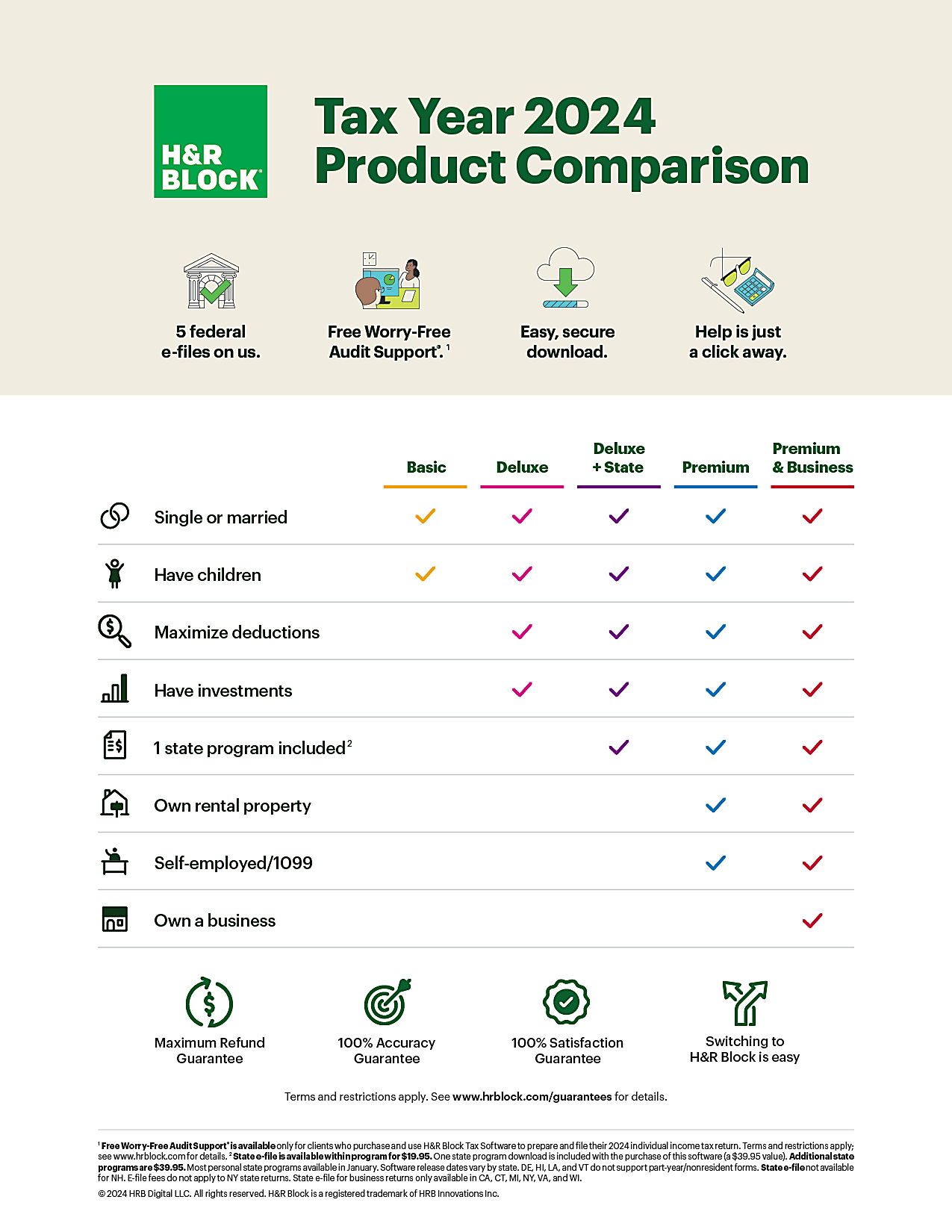

H&R Block Tax Software Deluxe + State 2024 [Download]

$39.99

- Instant Delivery & Download – access your software license keys and download links instantly.

- Works only on computers, not compatible with tablets.

- License once activated are non-refundable.

Includes:

- 1 federal program with 5 FREE federal e-files

- 1 state program (additional personal state programs are 39.95 dollars each)

- Most personal state programs available in January; release dates vary by state

- State e-file available for 19.95 dollars (state e-file not available in NH and fees do not apply to NY state returns)

Drag and drop last year’s tax information from TurboTax and other providers

Import your W-2, 1099, 1098, and last year’s personal tax return, even from TurboTax and Quicken software

Help Center search finds what you need from over 13,000 help articles

Schedule A allows you to itemize deductions

Advanced Schedule C guidance lets you maximize deductions for self-employment income

Schedule E guidance for rental property income and expenses

Check for issues, and assess audit risk with Accuracy Review

Tax calculators help determine the cost basis of sale, dividend, gift, and inheritance assets

Guidance on maximizing mortgage interest and real estate tax deductions

H&R Block DeductionPro values and optimizes charitable donations

Simple import from TurboTax and Quicken software

Step-by-step Q&A and guidance on all available credits and deductions

Five free federal e-files for your personal return, and unlimited federal preparation and printing

One personal state program download included

The H&R Block Tax Software minimum system requirements are for Windows and Mac are below.

Windows:

- Operating system: Windows® 10 or higher.

- Browser: Internet Explorer® 11 or higher

Mac:

- Operating system: Mac OS® X 12 or higher.

- Browser: Safari® 15.6.1 or higher.

General:

- Hard-Disk Space: 170MB

- Monitor: 1024×768, SVGA color monitor

- Printer: Compatible inkjet or laser

- Speakers and Sound Card: For videos / animations

You’ll also need an internet connection to meet H&R Block software system requirements.

Here’s how to install the H&R Block software you bought from hrblock.com:

How to Install H&R Block Software on Windows

- Open the purchase confirmation email and click the Download Program link to start the H&R Block download.

- Close all open applications.

- Open the downloaded file. If you can’t find the download file, see the Finding Your Downloaded File section below.

- Follow the instructions in the installation wizard to complete the installation. We recommend installing to the default location.

How to Install H&R Block Software on Mac

- Open the purchase confirmation email and click the Download Program link to start the H&R Block download.

- Close all open applications.

- Double-click the downloaded file. If you can’t find the download file, see the Finding Your Downloaded File section below.

- Follow the instructions to drag the file to the Applications folder.

Finding Your Downloaded File

If you’re still having trouble installing the H&R Block software you bought from our website or on a CD, here’s how to find the downloaded file from the steps above.

For Windows:

- Either push the Windows key and the letter Q at the same time, or click the Windows icon in the lower left corner of the screen.

- In the search field, type *hrb*.exe

- Press Enter.

- The installation file should appear in the resulting window. The file should have the letters HRB somewhere in the name.

- Double-click the file to start the installation.

For Mac:

- On the Apple toolbar located at the top of the screen on the desktop, click File.

- At the bottom of the drop-down menu, click Find.

- On the finder sidebar on the left of the screen, choose Mac HD.

- Type HRBlock in the Search box at the top right of the Finder window, and all files that begin with HRBlock will populate in the menu below.

- If you don’t have your confirmation email with the download link, you can request it again.

We only accept payments via credit card and do not accept PayPal.

All credit cards are processed through are payment gateway Authorize.net. We use SSL TLS encryption for all data transmitted to and from our web server. We are fully PCI-DSS compliant and do not store any credit card information on our server other than the last 4 digits.

Please contact your financial institution to verify your billing details. It is possible that your card will temporarily authorize each transaction even when the billing details do not match, but these charges are temporary and will fall off the statement within 1-2 business days. If you have any billing issues please contact customer service via our live chat.

We can offer refunds on purchases which demonstrate an adequate effort was made to solve the issue. Please see the product requirements page before purchasing (The majority of software has a minimum operating system (Windows or Mac) and a minimum operating system version requirement.

Our business model relies heavily on volume hence we are unable to provide phone support. You may however contact us using the live chat feature on our website for an interactive support experience. Most issues can be resolved quickly through live chat.

Yes, please use the live chat feature, and we can send you a link to a TeamViewer session.

Our system allows a guest checkout. But we encourage you to create an account to log in to download programs more safely.

Almost always the download link and license information is sent immediately with the order confirmation email. This information is always also available on the order history page under ‘my account’.

No, these devices will not run any software that is sold on our website.

Our system generates large volumes of email on a daily basis. It is likely that your email filters are flagging emails from our server as junk/bulk mail. Please check your Junk folder. If you still cannot find the email you can always contact us on live chat.

Use the “forgot password” link on the sign in page, otherwise contact support so that we may assist you with resetting your password, or helping you find the email used to create your account.

No, Microsoft has discontinued support for Windows 7, and we cannot offer support or any software compatible with Windows 7 systems. There are a number of reasons you may want to consider upgrading your system to a newer Windows operating system; security being most pertinent.

Please check the downloads manager in your web browser for the status of your download. Every time the download button is clicked on the website your browser may launch a new download without notifying you. To see a list of current and previous downloads: on Google Chrome press the CTRL + J keys (Windows) or CMD + J keys (MAC).

This is likely caused by a slow internet connection, or possibly a connection to our server. Contact us on live chat for help with alternative download mirrors.

For security reasons the download link may expire after a period of time. Contact support so that we may reset this for you.

To access your downloads:

- Scroll to the bottom of the page and click on 'Order History' under 'My Account'. You may also click the following link for the order history page: ORDERS

- Sign into your account with your email address and password.

- Click on 'view' next to your order.

- Click the 'download now' button

To download and install your software, please follow these instructions:

- To begin, click on "Download Now" button(s). Or follow the link to the manufacturers website. You may be prompted to "Run" or "Save" the file. Choose to save the file and continue.

- You may also be prompted to select a location where the file(s) should be saved on your local system. Choose a folder to save the file and click on "OK".

- If you are not prompted for a location, the file would be saved in the default location where your browser is setup to save all downloaded files (generally a folder named "Downloads"). Your download should begin.

- If there are multiple files, download all of them by clicking the 'download now' button next to each file name. Multiple files can be downloaded simultaneously.

- You may pause/resume an ongoing download using your browser's download manager functionality (if available).

- Once completed, please locate the installation file in the folder you selected and run the application to begin your installation.

Once downloaded, please select and execute the installation file and follow the on-screen instructions and enter your software license number when prompted.

Please contact support on our live chat system so that we can update your order.

For Turbotax and other products, the download and license number is available immediately upon purchase. There are cases where there may be a review period for security reasons or the licensing issuing system may be overloaded due to high order volume. If you received the message “Awaiting License” please contact live support for assistance.

Turbotax Deluxe, Premier, Home and Business, all come with 1 free state download. In order to fix issues with a corrupt state download follow the steps outlined in the article from Intuit or contact support for assistance: https://ttlc.intuit.com/community/tax-topics/help/state-loop-indicates-turbotax-is-up-to-date-after-updating-but-won-t-allow-you-to-install-your-state/00/1127787

Please check the License Code to make sure you have entered it correctly. Sometimes the S and the 5 or G and 6 look alike. It is best if you copy and paste the license number into the activation window to avoid invalid input. In other instances there may be a possible backend issue that you will need to contact support to resolve.

Related products

INSTANT EMAIL DELIVERY

All of our products are ready for an instant redemption after order is placed. Don’t wait for delivery elsewhere. Enjoy the true instant service by Guifff.Com.

ORIGINAL SOFTWARE

We only offer a genuine and legal products. You’ll be able to activate your software directly with Intuit, either online or on the phone servers.

SATISFACTION GUARANTEED

Our dedicated support team is ready to help you at any time to install your software or solve any issues you might have with your product.

.